Since the proprietary traders use their very own fund’s capital, they can inventory the securities for selling them to their purchasers (of banks or financial institutions) later. Also, the securities could be loaned out to purchasers who wish to promote short. Proprietary trading happens when a monetary establishment trades monetary instruments using its own money quite than shopper funds. This allows the firm to maintain the full amount of any features earned on the investment, probably providing a significant enhance to the agency’s profits. Proprietary buying and selling desks are generally “roped off” from client-focused trading desks, helping them to remain autonomous and ensuring that the monetary institution is performing in the interest of its shoppers. These trades are normally speculative in nature, executed through a wide selection of derivatives or different advanced investment vehicles.

Barclays’ prop desk spin-out takes shape – Financial News

Barclays’ prop desk spin-out takes shape.

Posted: Wed, 07 Jan 2015 08:00:00 GMT [source]

We have covered the fundamentals, initial steps and the steps for establishing a Proprietary Trading Desk, leading to beginning the trading process. As a testomony to our perception in your buying and selling abilities, we offer a novel bonus—keep each single cent of your first payout, up to a staggering $100,000.

Successful candidates will obtain an e mail with their account credentials and additional instructions on threat parameters. No, we are solely a Futures buying and selling prop agency and don’t support stock buying and selling. To illustrate the difference in costs, let’s assume you’re a 15 Lot dealer who completes three trades in a single day (which could be very conservative for a professional prop trader). Our business model is constructed on discovering and supporting nice merchants with as much capital as they’ll deal with.

Understanding Prop Store

It entails analysing the previous performance of a particular inventory, trade, or even a complete index after which leveraging established tendencies to tell trading selections in the present market conditions. By figuring out patterns and developments, traders can successfully decide when to purchase or promote assets. The practice of proprietary trading provides the benefit of larger earnings in comparability with earning commissions as a dealer. The trading firm retains all the income generated in this type of buying and selling, leading to a extra lucrative end result. Proprietary trading corporations have advanced technological methods to provide merchants with top-notch trading experiences via numerous instruments.

Proprietary trading corporations prioritising excellence strongly emphasise the significance of mentorship and training, significantly for traders simply beginning out within the industry. These corporations provide personalised one-on-one coaching classes to address particular buying and selling obstacles and objectives that every dealer may face. Top prop companies supply a complete vary of academic supplies designed to cater to the wants of each novice and seasoned traders. These useful resources prop desk cover a broad spectrum of buying and selling knowledge, from basic ideas to sophisticated methods, and are offered in various codecs. Prop buying and selling is a form of work in some business companies’ monetary markets, which implies utilizing solely one’s own funds in trading. As a rule, such corporations work on a quantity of obtainable markets and platforms, sending solely their capital to the accounts with out attracting funds from non-public or authorized entities from outside.

Nonetheless, they must additionally navigate the complexities of risk management and capital preservation to sustain their buying and selling operations successfully. Risk administration is the identification, evaluation, and mitigation of dangers. This might be adopted by a coordinated and economical application of assets to attenuate the impact of unlucky occasions or to maximise the belief of opportunities. A risk management system (RMS) is installed inside an algorithmic buying and selling platform to manage and mitigate the dangers of information entry, consistency and quality of information, community protocols, and scalability elements. The second benefit is that the establishment is prepared to stockpile a list of securities. First, any speculative stock allows the institution to offer an unexpected benefit to clients.

Access Vip Networking

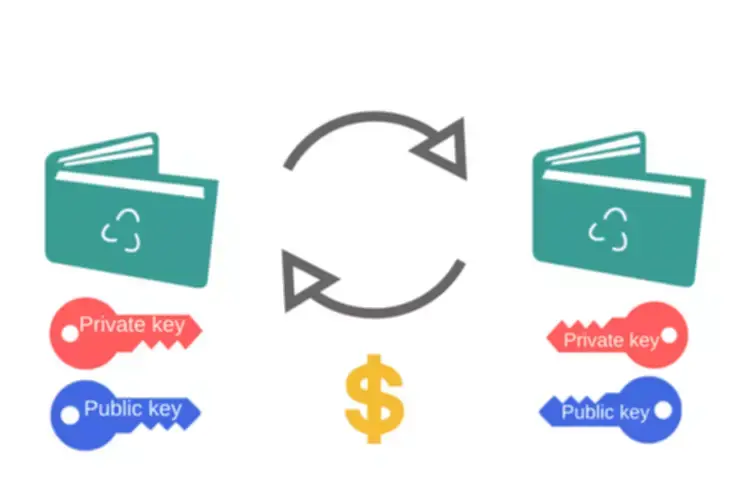

In proprietary desks, the transactions are carried out utilizing varied financial instruments corresponding to shares, bonds, commodities, currencies, and so forth. Proprietary trading desks do not work on behalf of their shoppers; as an alternative, they invest their cash and earn profit. Numerous futures prop trading companies present compensation structures that are tied to efficiency.

This means they take on the risk and reward of their trading actions directly. As unbiased entities, prop outlets usually are not subjected to the precise regulatory requirements as broker-dealers. Proprietary traders profit from a excessive stage of autonomy, allowing them to navigate the trading panorama on their very own phrases. Unlike conventional traders, they are not confined by mounted schedules or stringent laws, enabling them to implement trades based on their unique approaches, evaluation, and market views.

Occasions & Announcements

This unique alternative not solely allows them to increase their understanding of the market but also enables them to establish significant connections that may show invaluable in their buying and selling journey. Most of the regulated exchanges will also ask you to take care of audit logs, commerce logs and incident screens (to monitor crashes and so on.). In most international exchanges, the buying and selling members need to keep away from wasting the transaction logs for anyplace between 4 to eight years, relying on the geography or jurisdiction. Almost all the exchanges provide a test surroundings where you can develop and take a look at your systems and techniques.

This sense of safety stems from the substantial sources and assist major financial organisations present, guaranteeing a steady basis for buying and selling activities. When the interested buyers purchase those securities from the proprietary trading agency at a higher price than what the agency had paid for buying the securities, then solely there is a profit to the agency. Hence, this manner the liquidity will get infused in the market which is the principle goal of market making technique. Trend following is regarded as one of the intuitive prop buying and selling methods.

Simply trade a simulated account and prove you could be worthwhile without breaking any rules. So, if you need to be taught extra about Prop Trading Desk, register today as an intern, enhance your information and expertise in varied aspects and begin executing numerous strategies to earn a revenue. During 2008, there was a big crisis within the stock market, and the reason behind the crisis was Prop Desk Trading India.

There are totally different formalities that you may be required to adhere to when registering the firm/entity. Collaborate, be taught, and grow with friends, set up yourself as a frontrunner, and elevate your trading journey to heights previously unimaginable. Benefit from daily mentorship sessions with our seasoned leadership group. With Apteros, it is not nearly trading, it’s about holistic growth within the trading universe. It’s a real-time buying and selling analysis designed to check your trading talents. Prove you’ll find a way to handle danger whereas putting up returns and you’ll earn a spot on our group.

What’s Prop Trading And What Does It Stand For?

By operating at such rapid speeds, HFT corporations goal to reap the advantages of minor worth discrepancies out there and generate income from short-term trading opportunities. Many want to know what proprietary buying and selling companies are and what they do, likewise there are numerous who construct and setup their very own proprietary buying and selling desk. That is the explanation we have segregated this text into numerous sections explaining the which https://www.xcritical.com/ means, initial steps and the further steps as nicely. Financial institutions have interaction in proprietary trading as a way of benefitting from perceived aggressive benefits and maximizing their income. Since proprietary trading makes use of the agency’s personal cash quite than funds belonging to its shoppers, prop traders can take on greater ranges of risk without having to reply to shoppers.

Our 24/7 threat oversight ensures that there’s at all times a human eye safeguarding your trades, making certain minimized risks and maximized peace of thoughts. With no time constraints, take so long as you should move our tryout. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, the place he launched his personal monetary advisory agency in 2018. Thomas’ experience offers him experience in a wide range of areas including investments, retirement, insurance coverage, and financial planning.

News Buying And Selling

For each a scholar and a non-student newbie in the buying and selling area, learning algorithmic trading is optional. Although, the world has virtually fully shifted to algorithmic buying and selling including Wall Street. When you step into the financial market and begin buying and selling, you get to know the actual challenges and finding the options with the proper buying and selling technique is what makes you higher.

The prospect of working alongside proficient traders and seasoned professionals presents traders an distinctive avenue for studying and networking. By becoming a member of forces with different gifted people and trade veterans, traders can faucet into a wealth of information and experience. Engaging in webinars and stay periods, traders can actively participate in interactive studying periods that enable them to accumulate new trading strategies. Proprietary buying and selling is helpful and simultaneously includes different levels of prices depending on the steps such as the educational background (initial steps), market access, capital arrangement (advanced steps) and so on.

Also often identified as “prop trading,” this sort of trading activity occurs when a monetary agency chooses to revenue from market activities rather than thin-margin commissions obtained via client trading activity. Proprietary buying and selling might contain the buying and selling of stocks, bonds, commodities, currencies, or different devices. Proprietary buying and selling corporations enhance market liquidity and effectivity throughout the monetary ecosystem. These firms actively commerce a diverse vary of economic instruments, corresponding to equities, derivatives, and Forex, performing as intermediaries that contribute to stabilising asset prices. However, proprietary trading desks can even function as market makers, as outlined above.